Mortgage payment in excel

Author: s | 2025-04-24

Vertex42 Mortgage Payment Calculator free download - Mortgage Payment Calculator for Microsoft Excel Mortgage Payment Calculator Lite Mortgage payment calculator ND and. Excel Excel Online Excel for iPadiPhone OpenOffice Google Sheets. Download this free Mortgage Payment Calculator spreadsheet to compare monthly payments on different mortgages. Download a Mortgage Payment Calculator for Excel

Mortgage Payment Calculator for Excel

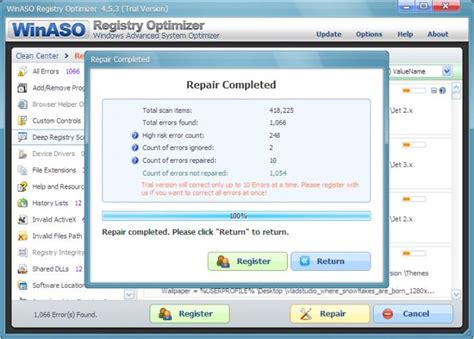

Rate mortgage, but the interest rate can increase over time, causing the monthly payment to increase as well.A Fixed Rate Mortgage is a mortgage loan where the interest rate is fixed for the entire term of the loan, which typically ranges from 15 to 30 years. The monthly payment remains the same for the life of the loan, making it easier to budget and plan.A mortgage excel template is a tool that can be used to compare the cost of different mortgage options, including ARMs and fixed rate mortgages. By inputting the loan amount, interest rate, and loan term, the template can calculate the monthly payment, total interest paid, and total cost of the loan. This can help borrowers make informed decisions about which type of mortgage is best for their financial situation.In conclusion, both ARM and fixed rate mortgages have their pros and cons. It’s important to weigh these factors and use a mortgage excel template to help compare costs and determine which type of loan is best for you.Download and use this excel templateTo use this free excel template, you should have Microsoft Office/ Microsoft Excel installed in your system.After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software.Once extracted, you can open the file using Excel and start entering data or customizing the template. You can customize the currency, color scheme, fields in this excel template as per your requirement. If the excel templates can not. Vertex42 Mortgage Payment Calculator free download - Mortgage Payment Calculator for Microsoft Excel Mortgage Payment Calculator Lite Mortgage payment calculator ND and. Excel Excel Online Excel for iPadiPhone OpenOffice Google Sheets. Download this free Mortgage Payment Calculator spreadsheet to compare monthly payments on different mortgages. Download a Mortgage Payment Calculator for Excel Step 3: Calculate Mortgage Payment in Excel. Then, we’ll calculate monthly payments and the principal and interest split using Excel functions. What is Mortgage Payment Formula in Excel? The main mortgage payment formula in Excel is PMT function. Actually, Excel has a bunch of built-in functions to calculate amortization payments for loans. Step 3: Calculate Mortgage Payment in Excel. Then, we’ll calculate monthly payments and the principal and interest split using Excel functions. What is Mortgage Payment Formula in Excel? The main mortgage payment formula in Excel is PMT function. Actually, Excel has a bunch of built-in functions to calculate amortization payments for loans. Step 3: Calculate Mortgage Payment in Excel. Then, we’ll calculate monthly payments and the principal and interest split using Excel functions. What is Mortgage Payment Formula in Excel? The main mortgage payment formula in Excel is PMT function. Actually, Excel has a bunch of built-in functions to calculate amortization payments for loans. 3 Ways to Estimate Your Monthly Mortgage Payment Use a Mortgage Calculator. Calculate Monthly Mortgage Payments in Excel. Spreadsheet programs, such as Microsoft Excel and Step 3: Calculate Mortgage Payment in Excel. Then, we’ll calculate monthly payments and the principal and interest split using Excel functions. What is Mortgage Payment Step 3: Calculate Mortgage Payment in Excel. Then, we’ll calculate monthly payments and the principal and interest split using Excel functions. What is Mortgage Payment Updated July 27, 2023Mortgage Formula (Table of Contents)FormulaExamplesWhat is Mortgage Formula?The term “mortgage” refers to the debt instrument against which the borrower is obligated to pay a predetermined set of payments. Typically, a mortgage is secured by collateral in the form of real estate property, equipment, etc.The formula for a mortgage primarily includes the fixed periodic payment and the outstanding loan balance. The formula for fixed periodic payment can be expressed using the outstanding loan amount, rate of interest, tenure of the loan and number of periodic payments per year. Mathematically, it is represented as,Fixed Periodic Payment = P *[(r/n) * (1 + r/n)n*t] / [(1 + r/n)n*t – 1]where,P = Outstanding Loan Amountr = Rate of interest (Annual)t = Tenure of Loan in Yearsn = Number of Periodic Payments Per YearOn the other hand, the formula for outstanding loan balance at the end of m years can be derived as below,Outstanding Loan Balance = P * [(1 + r/n)n*t – (1 + r/n)n*m] / [(1 + r/n)n*t – 1]Examples of Mortgage Formula (With Excel Template)Let’s take an example to understand the calculation of Mortgage in a better manner.You can download this Mortgage Formula Excel Template here – Mortgage Formula Excel TemplateMortgage Formula – Example #1Let us take the example of XYZ Ltd that has availed a $2,000,000 term loan to set up a technology-based company. As per the terms of sanction, the annualized rate of interest is 8%, the tenure of the loan is of 5 years, and the loan has to repay on a monthly basis. Calculate the fixed monthly payment based on the given information.Solution:Fixed Monthly Payment is calculated using the formula given below.Fixed Monthly Payment = P *[(r/n) * (1 + r/n)n*t] / [(1 + r/n)n*t – 1]Fixed Monthly Payment = $2,000,000 * (8%/12) * (1 + 8%/12)12*5 / [(1 + 8%/12)12*5 – 1]Fixed Monthly Payment = $40,553Therefore, the Fixed Monthly Payment for XYZ Ltd is $40,553.Mortgage Formula – Example #2 Let us take another example where the company has borrowed a loan of $1,000,000 that has to be repaid over the next 4 years. TheComments

Rate mortgage, but the interest rate can increase over time, causing the monthly payment to increase as well.A Fixed Rate Mortgage is a mortgage loan where the interest rate is fixed for the entire term of the loan, which typically ranges from 15 to 30 years. The monthly payment remains the same for the life of the loan, making it easier to budget and plan.A mortgage excel template is a tool that can be used to compare the cost of different mortgage options, including ARMs and fixed rate mortgages. By inputting the loan amount, interest rate, and loan term, the template can calculate the monthly payment, total interest paid, and total cost of the loan. This can help borrowers make informed decisions about which type of mortgage is best for their financial situation.In conclusion, both ARM and fixed rate mortgages have their pros and cons. It’s important to weigh these factors and use a mortgage excel template to help compare costs and determine which type of loan is best for you.Download and use this excel templateTo use this free excel template, you should have Microsoft Office/ Microsoft Excel installed in your system.After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software.Once extracted, you can open the file using Excel and start entering data or customizing the template. You can customize the currency, color scheme, fields in this excel template as per your requirement. If the excel templates can not

2025-04-15Updated July 27, 2023Mortgage Formula (Table of Contents)FormulaExamplesWhat is Mortgage Formula?The term “mortgage” refers to the debt instrument against which the borrower is obligated to pay a predetermined set of payments. Typically, a mortgage is secured by collateral in the form of real estate property, equipment, etc.The formula for a mortgage primarily includes the fixed periodic payment and the outstanding loan balance. The formula for fixed periodic payment can be expressed using the outstanding loan amount, rate of interest, tenure of the loan and number of periodic payments per year. Mathematically, it is represented as,Fixed Periodic Payment = P *[(r/n) * (1 + r/n)n*t] / [(1 + r/n)n*t – 1]where,P = Outstanding Loan Amountr = Rate of interest (Annual)t = Tenure of Loan in Yearsn = Number of Periodic Payments Per YearOn the other hand, the formula for outstanding loan balance at the end of m years can be derived as below,Outstanding Loan Balance = P * [(1 + r/n)n*t – (1 + r/n)n*m] / [(1 + r/n)n*t – 1]Examples of Mortgage Formula (With Excel Template)Let’s take an example to understand the calculation of Mortgage in a better manner.You can download this Mortgage Formula Excel Template here – Mortgage Formula Excel TemplateMortgage Formula – Example #1Let us take the example of XYZ Ltd that has availed a $2,000,000 term loan to set up a technology-based company. As per the terms of sanction, the annualized rate of interest is 8%, the tenure of the loan is of 5 years, and the loan has to repay on a monthly basis. Calculate the fixed monthly payment based on the given information.Solution:Fixed Monthly Payment is calculated using the formula given below.Fixed Monthly Payment = P *[(r/n) * (1 + r/n)n*t] / [(1 + r/n)n*t – 1]Fixed Monthly Payment = $2,000,000 * (8%/12) * (1 + 8%/12)12*5 / [(1 + 8%/12)12*5 – 1]Fixed Monthly Payment = $40,553Therefore, the Fixed Monthly Payment for XYZ Ltd is $40,553.Mortgage Formula – Example #2 Let us take another example where the company has borrowed a loan of $1,000,000 that has to be repaid over the next 4 years. The

2025-04-05Loan repayment is the act of paying back money previously borrowed from a lender, typically through a series of periodic payments that include principal plus interest. Did you know you can use the software program Excel to calculate your loan repayments? This article is a step-by-step guide to setting up loan calculations.Key Takeaways:Use Excel to get a handle on your mortgage or loan by determining your monthly payment, your interest rate, and your loan schedule.You can take a more in-depth look at the breakdown of a loan with Excel and create a repayment schedule that works for you.There are calculations available for each step that you can tweak to meet your specific needs.Breaking down and examining your loan step-by-step can make the repayment process feel less overwhelming and more manageable. Understanding Your Mortgage Using Excel, you can get a better understanding of your mortgage in three simple steps. The first step determines the monthly payment. The second step calculates the interest rate, and the third step determines the loan schedule. You can build a table in Excel that will tell you the interest rate, the loan calculation for the duration of the loan, the decomposition of the loan, the amortization, and the monthly payment. Step 1: Calculate the Monthly Payment First, here's how to calculate the monthly payment for a mortgage. Using the annual interest rate, the principal, and the duration, we can determine the amount to be repaid monthly. The formula, as shown in the screenshot above, is written as follows: =-PMT(rate;length;present_value;[future_value];[type]) The minus sign in front of PMT is necessary as the formula returns a negative number. The first three arguments are the rate of the loan, the length of the loan (number of periods), and the principal borrowed. The last two arguments are optional; the residual value defaults to zero, and payable in advance (for one) or at the end (for zero) is also optional. The Excel formula used to calculate the monthly payment of the loan is: = PMT((1+B2)^(1/12)-1;B4*12;B3)=PMT((1+3,10%)^(1/12)-1;10*12;120000) For the rate, we use the monthly rate (period of rate), then we calculate the number of periods (120 for 10 years multiplied by 12 months) and, finally, we indicate the principal borrowed, which is $120,000. Our monthly payment will be $1,161.88 over 10 years. Step 2: Calculate the Annual Interest Rate We have seen how to set up the calculation of a monthly payment for a

2025-03-27P * [(r/n) * (1 + r/n)n*t] / [(1 + r/n)n*t – 1]Step 6: On the other hand, the outstanding loan balance after m years is computed by adding the total interest accrued for m*n months and subtracting the total fixed periodic payments from the initial outstanding loan (P) and it is represented as shown below,Outstanding Loan Balance = P * [(1 + r/n)n*t – (1 + r/n)n*m] / [(1 + r/n)n*t – 1]Relevance and Use of Mortgage FormulaFrom the perspective of both borrowers and lenders, it is very important to understand the concept of mortgage because almost all companies used a mortgage to expand or support their business operations. The formula for a mortgage is used to chalk out the amortization schedule of a loan that provides clear bifurcation of the fixed periodic payment and interest expense incurred during each period.Recommended ArticlesThis is a guide to Mortgage Formula. Here we discuss how to calculate Mortgage along with practical examples. We also provide a downloadable excel template. You may also look at the following articles to learn more –How to Calculate Current Yield of Bond?Taxable Income Formula with Excel TemplateCalculation of Effective Tax RateExamples of Correlation Formula

2025-04-20This easy to use calculator is a must for science students. It includes triangle calculators, vector calculators, shape calculators, statistical calculators, measurement converters, 3000 compounds, 2000 formulas, 100 constants and 400 symbols.File Name:dpls_science_calc.zip Author:Dot Point Learning SystemsLicense:Freeware (Free)File Size:15.36 MbRuns on:Win2000, WinXP, Win7 x32, Win7 x64, Windows 8, Windows 10, WinServer, WinOther, WinVista, WinVista x64 Advertisement Advertisement Decanters are used for liquid-liquid separation when there is a sufficient difference in density between liquids for the droplets to settle. Decanter sizing calculator (DSC) is a software that is built to size horizontal and vertical decanters. ...File Name:dscsetupdemo.zip Author:WeBBusterZ EngineeringSoftwareLicense:Demo ($62.00)File Size:3.7 MbRuns on:Windows 7, Windows 8, Windows 10, Windows 11, Windows Server, Windows OtherAn easy-to-use calculator with a visual tape that works like a spreadsheet, saving all calculations and permitting entries to be updated. One-click integration with Microsoft Excel allows simple calculations to evolve into complex spreadsheets.File Name:actic25.zip Author:Parmerlee, Inc.License:Shareware ($25.00)File Size:1.88 MbRuns on:Win95, Win98, WinME, WinXP, Windows2000Free Subnet Calculator tool from SolarWinds generates all subnets with real-time DNS, PING and CIDR tests. This application provides address details, a classful subnet creator, a CIDR calculator and subnet address lists that can be exported.File Name:SolarWinds-Subnet-Calculator.exe Author:SolarWindsLicense:Freeware (Free)File Size:9.41 MbRuns on:WinNT 3.x, WinNT 4.x, Windows2000, WinXP, Windows2003DJ Mix Pro is a smart MP3 player and mixer that performs fully automatic quality DJ mixes ( cross fading, beat matching) between all songs.It proposes a new approach of DJ mixing since you can build and listen to your mix before they are played.File Name:DJ Mix Pro Author:Beatlock TechnologyLicense:Shareware ($40.00)File Size:Runs on:Win95, Win98, WinME, WinNT 4.x, WinXP, Windows2000File Name:loan-calculator-setup.exe Author:Wheatworks Software, LLCLicense:Freeware (Free)File Size:758 KbRuns on:WinNT 4.x, Windows2000, WinXP, Windows2003, Windows VistaCalculate mortgage loan payments with this free mortgage payment calculator for Windows This free mortgage payment calculator for Windows allows you to quickly calculate mortgage loan payments. Free Mortgage Payment Calculator is a financial calculator designed for Windows 2000, XP and Vista systems.File Name:mpcsetup.exe Author:Wheatworks Software, LLCLicense:Freeware (Free)File Size:834 KbRuns on:WinNT 4.x, Windows2000, WinXP, Windows2003, Windows VistaCompare 135 loans at once with LoanSpread Loan Comparison Calculator and drill down into a loan summary of any of the 135 you choose. Displays answers of loan amounts, interest rates, terms in months, or payment amounts based upon your loan variables. ...File Name:loanspreadsetup.exe Author:Wheatworks Software, LLCLicense:Shareware ($39.95)File Size:2.17 MbRuns on:WinNT 4.x, Windows2000, WinXP, Windows2003, Windows VistaThe MoneyToys - Loan Spread Calculator applet is designed to provide webmasters with

2025-03-30Calculates the periodic payment needed to pay off a loan with a fixed interest rate over a set number of periods.Can I use the PMT function for other types of payments?Yes, the PMT function can also be used to calculate payments for other types of financial scenarios, like savings goals or annuities.What if my interest rate changes?The PMT function is designed for fixed-rate loans. For variable-rate loans, you’ll need to adjust the formula or consider using more complex financial modeling.Why is the payment value negative?The PMT function returns a negative value because the payment represents an outflow of money. You can use the ABS function to convert it to a positive number if needed.Can I use the PMT function for yearly payments?Yes, just be sure to input the interest rate and number of periods as annual values instead of monthly ones.SummaryOpen Excel and create a new spreadsheet.Enter the loan information.Click on an empty cell for the result.Enter the PMT function.Press Enter.ConclusionUsing the PMT function in Excel is a straightforward way to calculate periodic loan payments. This can be an invaluable tool for anyone looking to manage their finances more effectively, whether it’s for a mortgage, car loan, or any other type of installment loan. By mastering this function, you can make more informed financial decisions and plan your budget with greater accuracy. Remember, while Excel can crunch the numbers, it’s crucial to double-check your inputs to ensure accuracy. For further reading, you might explore other financial functions in Excel like

2025-04-16